In 2007 when I graduated university (just before I was about to embark on a 3 year travel stint around the globe) I set a financial goal for myself to save $50,000. I didn’t have a time stamp on when I wanted to achieve this goal as I really wanted to see how long it would take me to collect all my pennies and save them in the bank by simply “living within my means.”

Last month when I sat down to do my monthly finances I was thrilled to discover that I had finally reached my savings goal! I shared my financial success with a few friends and family and was fascinated by the responses I received. One camp offered their own savings tips and were enthusiastic and encouraging, the other group were bewildered that I had managed to save so much at a young age (on a freelancing salary no less) and pressed me to write a story detailing how I’ve managed to realize financial success in a time where many Millennials are perceived as underemployed and underpaid while trying to find jobs in cities where rents are skyrocketing and the idea of owning a home and raising a family in a backyard seems like a dream that may never come true.

I wanted to share my story to debunk the myth that Millennials are all lazy and entitled and in fact point out that some of us find saving sexy. In my opinion there’s nothing more attractive than connecting with someone who is able to comfortably live within their means.

The media’s narrative on Millennials likes to highlight the fact that we all grew up with helicopter parents who did our laundry, cooked our meals, applied to universities on our behalf (gasps), subsidize our incomes as adults so we can live a “comfortable lifestyle” and pretty much never allowed us the opportunity to fail, learn from our mistakes and take responsibility for our lives. We grew up with a string of reality TV shows that celebrated excessive spending. “I want it now,” became a part of our psyche and culture.

No you do not deserve to ride on a pony at your high school graduation. No you do not deserve a BMW when you turn 18. Owning a designer purse is not a need it is a want, which you likely can’t afford. Not everyone can eat out every night of the week and the phone you bought last year still works fine.

While my generation has been painted with a certain brush (and I certainly know plenty of peers who live and breath this mantra), there are plenty of 20-30 year olds who are working hard to save their money and invest in the future.

Linda Mackay, senior vice-president of retail savings and investing at Toronto-Dominion Bank says, “Canadian millennials definitely face competing financial priorities like paying down student loans, living at home or renting their own place or even how much to allocate to entertainment and going out. They also have competing sources of advice on how to balance those priorities. Millennials can learn a lot about the fundamentals of personal finance from their parents, family and friends. In addition, talking to a financial advisor can really help set them up for success both on short-term and long-term financial goals. The fundamentals of personal finance, such as managing a budget, don’t change from generation to generation – it’s balancing dollars flowing in against where you need vs. want to spend. What can change are economic realities facing younger Canadians, which is why they should build a strong financial routine early with the right blend of professional and familial financial advice.”

Whether you feel totally lost with your finances and have debt up to your eyeballs, or are fairly confident you tackle your finances well but know you need to start saving now for a car, house and retirement…the following 10 tips on realizing your financial goals should offer motivation and inspiration so you can bring sexy saving back where it belongs. Your wallet.

Never take cash out at competitor ATMs.

You’ll avoid racking up unnecessary fees. I always have a minimum of $200 at home stored in my sock drawer (and since I travel a lot also have a selection of Euros, Pounds and US Dollars on hand) so I’m never desperate for cash at the last minute when heading out the door.

Always pay your credit card on time.

I’m happy to say I’ve never paid my credit card late, avoiding those hefty interest fees. Only charge your card if you know you can afford what you’re purchasing and can pay it off on time. Set up monthly automatic credit card payments so you never have an excuse for paying your bill late.

Find a credit card that adds value to your life.

I’m an avid traveler so the TD Aeroplan Visa has worked wonders for me. I save over a thousand dollars each year on travel insurance as it’s covered by the card for trips up to two weeks in length. I also pay for everything with my credit card (from restaurant meals to a pack of gum) to ensure I’m racking up points which I can use to fund a trip in the future.

Enjoy what’s free at home.

Grab a guidebook of your city (there’s a Rough Guides Toronto you know) and treat your home sweet home as a travel destination. You’ll be amazed to find a ton of free experiences in your city! Many museums have free admission days, festivals throughout the year often offer ticketless programming and in cities like Toronto there are endless trails, parks and islands worth discovering.

Take advantage of a good deal.

Whether you are at the grocery store, pharmacy or your favourite clothing store, make a conscious effort to make purchases when items are on sale (and if the business has a point system take advantage of those as well). Whenever I visit my local grocery store I look to see what produce, meat and pantry items are on sale and throw them into my basket. I enjoy crafting meals this way as it forces me to be creative. If books and boots are your thing, you can bookmark items you want to purchase online and wait until sale time. Once items get reduced, you already have them tagged, so you can buy the ones that are still available in your size at better prices.

Schedule an automatic withdrawal from every paycheck

If you get used to having a reduced income which goes directly to a savings account you’ll manage your budget better and have the comfort in knowing you’re stashing your hard earned money away for big ticket items such as a vacation, car or home purchase.

Get real with your expenses.

If you’re not tracking your expenses each month you need to start immediately. Like those who hop on the diet train I know it can be challenging to face your fears and stare at your overconsumption in the face. By plugging in your expenses each month you can see where your money is going, which will help you cut back on unnecessary expenses. Do you really need to spend $500 a month on UBER or could you wake up a bit earlier and walk or bike to work (and that exercise also does wonders). Can you brew your own coffee at home instead of spending $10 on a latte at Starbucks? Do you really need 20 pairs of jeans?

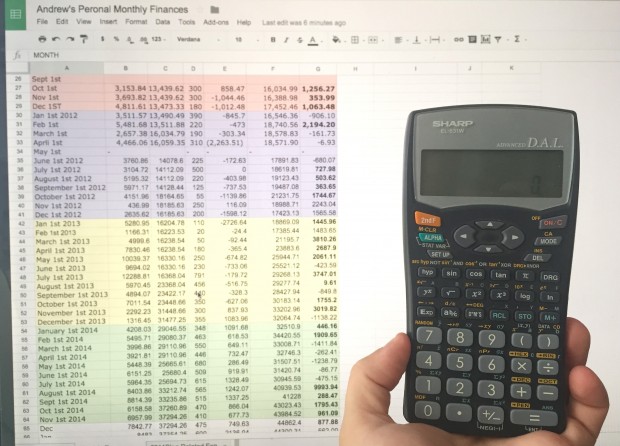

Create a routine and fall in love with your spreadsheet.

I know you might eye roll at me when I say I actually look forward each month to doing my finances. Once you’re on track with a “saving for the future” state of mind it’s actually rather thrilling to see your savings skyrocket (and for many money miss-managers alleviates a huge stress/emotional burden). For the last five years I’ve done my finances on the 1st of every month. I go through my credit card statement and chequing account to document all of my work related expenses on a spreadsheet and then add up my net worth (savings account + chequing account + cash on hand – credit card bill owing). I subtract my networth each month from the the previous total and quickly realize how much I’ve saved over the last 30 days.

One of the biggest benefits of tracking your expenses and income each month is that you’re effectively preparing your taxes throughout the year. For the past few years I have wow’d my family’s accountant by submitting my expenses and income on the morning of New Years Day. It takes me approximately 30 minutes to jot down the transactions in December and quickly export my spreadsheets. Why are people stressing out about their taxes in April? I just don’t get it!

Think about your retirement.

TD recommends setting up a series of regular payments into an RSP, one of the easiest ways of saving money for the future and possibly reducing tax obligations. And despite this, nearly half of Canadians don’t contribute to one and more than a third of those who do wait until close to the annual deadline. Regular contributions can help people reach their ‘freetirement’ dreams even faster. You can also turn tax returns into ongoing returns: 70 per cent of Canadians expect to get a tax return this year and many of them plan to save at least part of it in an RSP, TFSA or other savings account. An easy way to boost retirement funds is to consider increasing the amount of the refund saved, as well as saving any bonuses or monetary gifts received during the year.

Mortgage Musings.

While the real estate market may move fast, TD advises that buyers shouldn’t rush their decision. Take the time to make an informed decision based on a realistic assessment of your budget, down payment and property type. A good place to start is to decide how much you’re comfortable spending and what the down payment will be. If pooling resources with others, you might be able to make a larger down payment. A larger down payment can be beneficial – the more money you pay upfront, the less you’ll need to borrow. If the down payment is more than 20%, you may avoid paying mortgage default insurance. Mortgage default insurance premiums are calculated as percentage of the mortgage and paid upfront or by adding it to the principal portion of the mortgage. Once you’ve set your budget, take your monthly mortgage payments for a test-drive by making an automatic transfer of that amount into a TFSA or other high-interest savings account. This two-fold approach allow you to see how comfortably you can pay off the monthly mortgage, while also helping you save for a larger down payment.

great article, Andrew!

so have you actually made any contributions to an RRSP? If so, that’s wonderful

Financial Freedom is what we all desire, but it takes a lot of discipline and savings to get to where we all want to be.